IMPORTANT: Numeric entry fields must not contain dollar signs, percent signs, commas, spaces, etc. (only digits 0-9 and decimal points are allowed).

Click the Terms tab above for a more detailed description of each entry.

Step #1:

Enter the purchase price of the car.

Step #2:

Enter the current age of the car. If the car is new, enter a 0.

Step #3:

Enter the number of years you plan to own the car.

Step #4:

Optional: Enter the number of miles you expect to drive the car each year.

Step #5:

Enter the number of years to calculate lifetime depreciation costs.

Step #6:

Enter the annual percent return you would expect to earn on your investments.

Step #7:

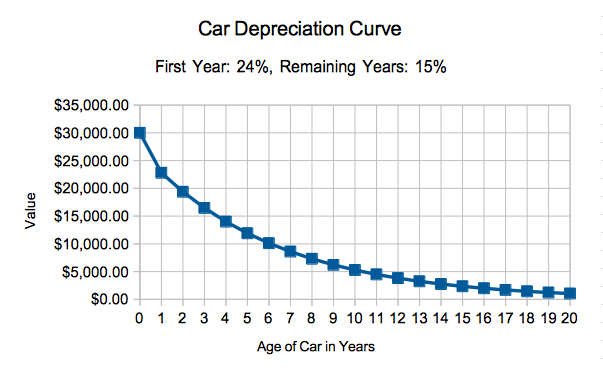

Adjust the year-to-year depreciation rates (if you don't agree with the default rates).

Step #8:

Click the "Calculate Car Depreciation" button.

Follow me on any of the social media sites below and be among the first to get a sneak peek at the newest and coolest calculators that are being added or updated each month.